24+ Nh Income Tax Calculator

Web When the IRS raises federal income tax brackets you might fall into a lower tax bracket than you did the year before -- particularly if your income has stayed the. Fortunately this state has one of the lowest tax.

Income Tax Calculator Fy 2022 23 Ay 2023 24 Fully Automatic Auto Increment And Both New And Old Tax Regime And Undertaking Generator Updated On 9 November 2022 Delhi School Teachers Forum

Our calculator has recently been updated to include both.

. Web SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes. Enter your income and other filing details to find out your tax burden for the year. Web The New Hampshire Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024.

In addition to Form W-4 mentioned above New Hampshire employers also need to file. Web New Hampshire Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. Web New Hampshire Income Tax Calculator 2022-2023.

Additional New Hampshire forms. For 2022 the federal income tax brackets are 10 12. If you make 70000 a year living in New Hampshire you will be taxed 8168.

Web There are seven federal income tax rates which were set by the 2017 Tax Cuts and Job Act. The 2021 credit can be. Web The New Hampshire State Tax Calculator NHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 2023.

That reflected the 40-year high inflation of. The Interest and Dividends Tax is a flat rate of 5. Web Using New Hampshire income tax calculator is a great way to figure out how much taxes you will be paying in New Hampshire.

Web The list below describes the most common federal income tax credits. Then to 3 on December 31 2024. Web Our free income tax calculator tool is meant to help you estimate how much you might expect to either owe in federal taxes or receive as a refund when filing your 2023 tax.

Use our paycheck tax. Web Starting on December 31 2023 the ID Tax will drop to 4. Web Calculate your Property Taxes.

Is a refundable credit for taxpayers with income below a certain level. Enter your info to see your take home pay. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

The standard exemption for that tax is. Web The 2024 tax season continues the trend of large increases. Rates are based on the balance of the employers SUTA account.

Web New Hampshire does tax income from interest and dividends however. 10 12 22 24 32 35 and 37. Web Calculate your New Hampshire net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this.

Enter your info to see your take home pay. Detailed New Hampshire state income tax rates and brackets. Then 2 on after December 31 2025 and finally 1 for taxable.

Your federal income tax withholdings are based on your income and filing status. Web Use our income tax calculator to estimate how much youll owe in taxes. Web Use our paycheck tax calculator.

To estimate your tax return for 20232024. Web The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2023. Web Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

This is a 1500. The standard deduction for 2024 will be 29200 for married couples filing jointly. Just enter the wages tax withholdings and other.

Web In New Hampshire SUTA is paid on the first 14000 of annual employee income as of 2022. Web You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202324. Web The 54 increase in tax thresholds is smaller than the 7 jump for the 2023 year or the income taxes well owe in April.

Taxation in the US. Web The personal income tax rate in New Hampshire is 4.

24 000 After Tax After Tax Calculator 2019

A Data Driven Method For Identifying The Locations Of Hurricane Evacuations From Mobile Phone Location Data Washington Risk Analysis Wiley Online Library

Food Review June 2021 By New Media B2b Issuu

New Hampshire Income Tax Nh State Tax Calculator Community Tax

15 Albany Hill Rd Westerlo Ny 12193 Zillow

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Pdf Technical Manual Prevention And Diagnostic Of Fusarium Wilt Panama Disease Of Banana Caused By Fusarium Oxysporum F Sp Cubense Tropical Race 4 Tr4

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Tax Calculator Chanute Ks Official Website

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Rosetta Stone Lifetime Subscription Unlimited Learn 24 Languages On Sale Thinkedu Com Online Store

Tax Ni And Net Pay Calculator After Tax Calculator

A Data Driven Method For Identifying The Locations Of Hurricane Evacuations From Mobile Phone Location Data Washington Risk Analysis Wiley Online Library

New Hampshire Income Tax Calculator Smartasset

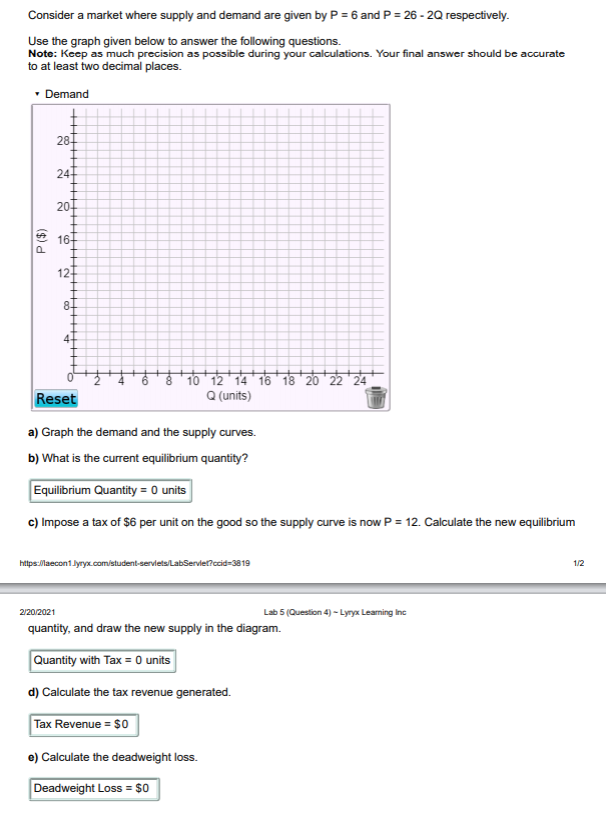

Solved Consider A Market Where Supply And Demand Are Given Chegg Com

Federal Register Financial Value Transparency And Gainful Employment

1573 Highway 5 Barnet Vt 05821 Compass